|

|

|

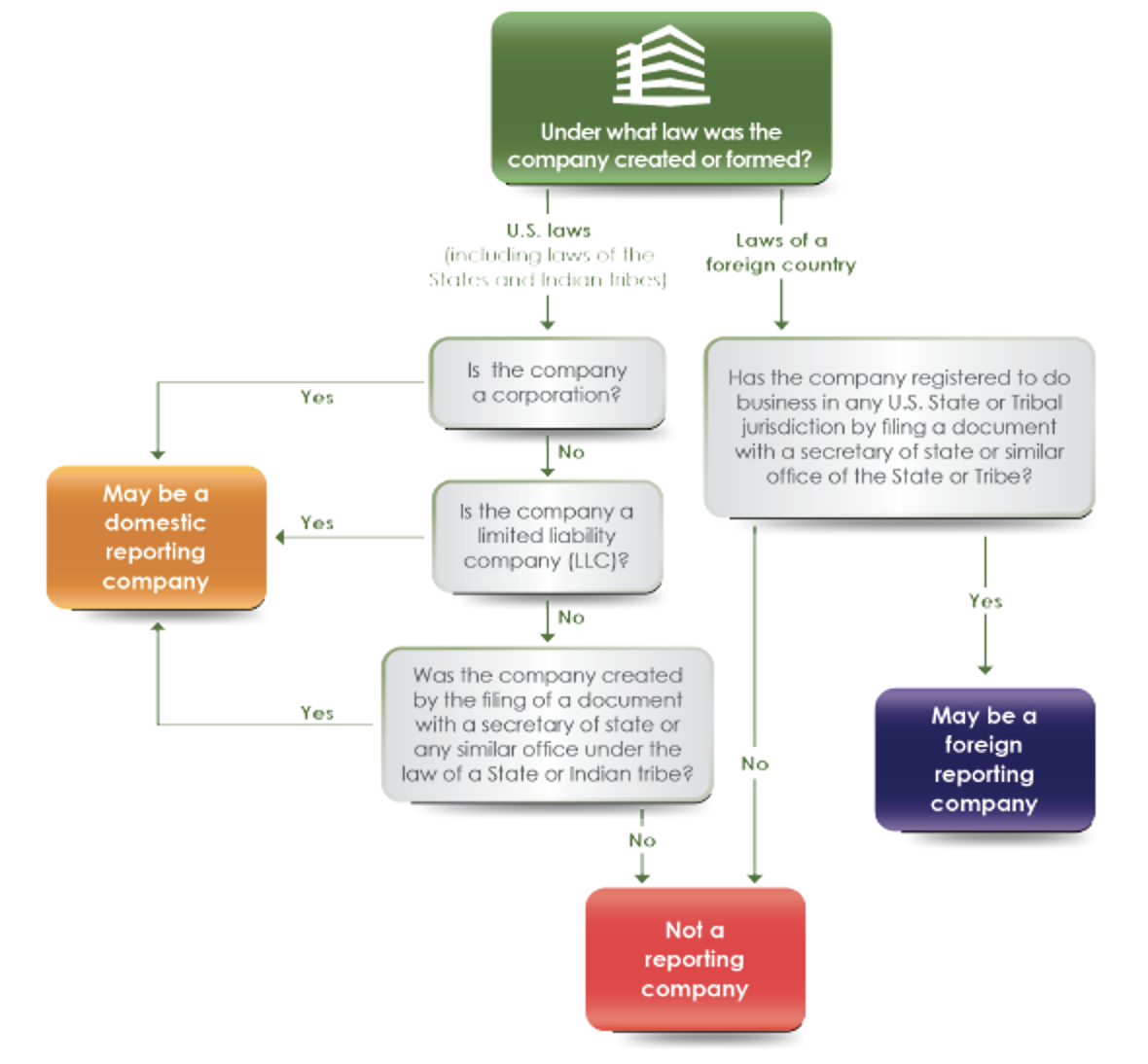

The Reporting Rule requires that all "reporting companies" file BOI reports with FinCEN within the previously specified timeframes. A reporting company is any entity that meets the "reporting company" definition and does not qualify for an exemption. There are two categories of reporting companies: a "domestic reporting company" and a "foreign reporting company". If your company is neither a "domestic reporting company" nor "foreign reporting company" because it does not meet either definition (as described below) or it qualifies for an exemption, then it is not required to file a BOI report with FinCEN.

The following chart shows how to analyze whether your company is a "reporting company":

Chart 1 - Reporting company definition

Unless otherwise specified, States and Indian tribes have the following meanings in this Guide and the Reporting Rule.