|

|

|

Your company can identify beneficial owners by taking the following steps:

Step 1: Identify individuals who exercise substantial control over the company.

Examples are provided below to help you identify those individuals.

Step 2: Identify the types of ownership interests in your company and the individuals that hold those ownership interests. Examples are provided below to help identification.

Step 3: Calculate the percentage of ownership interests held directly or indirectly by individuals to identify individuals who own or control, directly or indirectly, at least 25 percent of the ownership interests of the company.

Here are additional details on each step:

Step 1: Individuals may directly or indirectly exercise substantial control. Individuals can exercise substantial control through contracts, arrangements, understandings, relationships, or otherwise.

Examples of direct ways to exercise substantial control over a reporting company are:

Examples of indirect ways to exercise substantial control over a reporting company are:

While keeping these examples in mind, the following questions can help identify which individuals exercise substantial control over your company. Multiple criteria can apply to one individual.

Note for trusts: a trustee of a trust or similar arrangement may exercise substantial control over a reporting company.

| Substantial control question | Answer | If response is "Yes" |

|---|---|---|

|

o Yes o No |

There are senior officers in your company. |

Note: One individual may perform one or more functions for a company, or a company may not have an individual who performs any of these functions. |

o Yes o No |

|

|

o Yes o No |

There are individuals with appointment or removal authority over your company. |

|

o Yes o No |

|

Note: Certain employees who might fit this description are nevertheless exempt from the beneficial owner definition. See section 2.4 for more information. |

o Yes o No |

There are important decision-makers over your company. |

|

o Yes o No |

There are individuals to whom the catch-all would apply. |

Complete Step 1: Once you have reviewed the examples and questions for exercising substantial control above, you will have enough information to complete Step 1 (identify the individuals who meet the substantial control criteria for your company). The individuals you have identified will be reported as beneficial owners in your company's BOI report unless they qualify for an exception, as discussed in the next section of the chapter (section 2.4).

Step 2: Individuals may directly or indirectly own or control ownership interests. Individuals can own or control ownership interests through contracts, arrangements, understandings, relationships, or otherwise.

Examples of direct ways to own or control ownership interests in a reporting company are:

Examples of indirect ways to own or control ownership interests in a reporting company are:

While keeping these examples in mind, the following questions can help identify what types of ownership interests are relevant for your company. A company may have more than one type of ownership interest.

| Ownership interest question | Answer | If response is "Yes" |

|---|---|---|

|

o Yes o No |

Your company has ownership interests that are equity, stock, or voting rights. |

|

o Yes o No |

|

|

o Yes o No |

|

|

o Yes o No |

Your company has ownership interests that are capital or profit interests. |

Note: It does not matter whether anything must be paid to exercise the conversion. |

o Yes o No |

Your company has ownership interests that are convertible instruments. |

|

o Yes o No |

|

Note: It does not matter if such warrant or right is a debt. |

o Yes o No |

|

Note: Options or privileges created by others without the knowledge or involvement of your company do not apply. |

o Yes o No |

Your company has ownership interests that are options or privileges. |

|

o Yes o No |

The catch-all ownership interest applies to your company. |

Complete Step 2: Once you have reviewed the examples and questions for ownership interests above, you will have enough information to complete Step 2 (identify the individuals who hold ownership interests in your company). Step 3 will help you identify which of these individuals own or control 25 percent or greater of the ownership interests in your company. The individuals who own or control 25 percent or more of the ownership interests in your company will be reported as beneficial owners in your company's BOI report unless they qualify for an exception, as discussed in the next section of the chapter (section 2.4).

Step 3: After identifying what types of ownership interests apply to your company and who owns or controls them, you must determine who owns or controls 25 percent or more of those ownership interests.

If your company has issued any options, privileges, or convertible instruments:

> Assume they have been exercised or converted in all calculations below.

If your company issues shares of stock, is a corporation (including a Subchapter S corporation), or is not a corporation but is treated as one for federal income tax purposes:

> Calculate each individual's ownership interest as a percentage of the total shares of stock issued. If some shares of stock that your company issues have more voting power or represent more of the value of the company than other shares (for instance, if your company issues both series A shares with one vote per share and series B shares with ten votes per share), you will need to make the following two calculations. The individual's ownership interest will be the larger of the two percentages:

|

Total combined voting power of all classes of the individual's ownership interests ÷ Total outstanding voting power of all classes of ownership interests entitled to vote = Individual's voting power % |

Total combined value of the individual's ownership interests ÷ Total outstanding value of all classes of ownership interests = Individual's ownership interest value % |

If your company, including if your company is treated as a partnership for federal income tax purposes, issues capital or profit interests:

> Apply the following calculation:

|

Individual's capital and profit interests ÷ Total outstanding capital and profit interests = Individual's capital and profit interests % |

If none of these calculations apply to your company:

> Identify any individual who owns or controls 25 percent or more of any class or type of ownership interest of the company.

Complete Step 3: After you have applied these scenarios to your company's ownership interests, you will have enough information to identify the individuals who own or control 25 percent or greater of the ownership interests in your company. You must report the individuals who own or control 25 percent or more of the ownership interests in your company as beneficial owners in your company's BOI report unless they qualify for an exception, as discussed in the next section of the chapter (section 2.4).

Examples of how to determine beneficial owners:

The following examples show how to determine beneficial owners across a variety of types of company structures. These examples assume that no exceptions apply to the beneficial owners, as discussed in the next section of the chapter (section 2.4). In the infographics for the examples, beneficial owners are noted by circles and non-beneficial owners are noted by triangles.

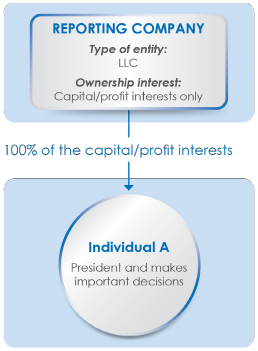

Example 1: The reporting company is a limited liability company (LLC). Individual A is the sole owner and president of the company and makes important decisions for the company. No one else owns or controls ownership interests in the company or exercises substantial control over the company.Individual A is a beneficial owner of the reporting company in two different ways, assuming no other facts. First, Individual A exercises substantial control over the company because Individual A is a senior officer of the company (the president). Second, Individual A is also a beneficial owner because Individual A owns 25 percent or more of the reporting company's ownership interests.

Because no one else owns or controls ownership interests in the LLC or exercises substantial control over it, and assuming there are no other relevant facts, Individual A is the only beneficial owner of this reporting company, and Individual A's information must be reported to FinCEN.

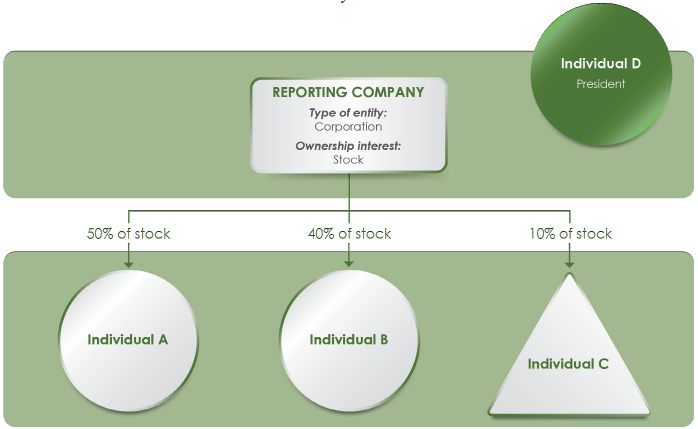

Example 2: The reporting company is a corporation. The company's total outstanding ownership interests are shares of stock. Three people (Individuals A, B, and C) own 50 percent, 40 percent, and 10 percent of the stock, respectively, and one other person (Individual D) acts as the president, for the company, but does not own any stock. Assuming there are no other relevant facts, Individuals A, B, and D are all beneficial owners of the company and their information must be reported. Individual C is not a beneficial owner.

Individual A owns 50 percent of the company's stock and therefore is a beneficial owner because 50 percent is greater than the threshold of 25 percent or more of the company's ownership interests.

Individual B owns 40 percent of the company's stock and therefore is a beneficial owner 40 percent is also greater than the threshold of 25 percent or more of the company's ownership interests.

Individual C is not a senior officer of the company and does not directly or indirectly exercise any substantial control over the company.

Individual C also owns 10 percent of the company's stock, which is less than the 25 percent or greater interest needed to qualify as a beneficial owner by virtue of ownership interests. Individual C is therefore not a beneficial owner of the company.

Individual D is president of the company. As a senior officer of the company, Individual D exercises substantial control over the company and is therefore a beneficial owner, regardless of whether or not Individual D owns or controls 25 percent or more of the company's ownership interests.

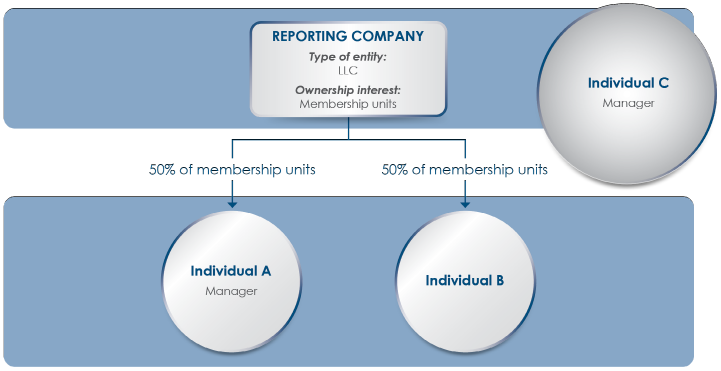

Example 3: The reporting company is an LLC with two managers, Individuals A and C. Individual A also owns 50 percent of the "membership units" in the LLC while Individual C does not. Individual B owns the remaining membership units in the LLC but is not a manager. Owners of membership units (which are a type of "capital or profit interest" ownership interest) in an LLC are sometimes called "members" of the LLC. A member may not automatically be required, or authorized, to make decisions for the LLC; depending on the internal organization of the LLC, however, a member may also be a "manager." In this example, Individual A is a member and a manager. Individual B is a member but not a manager, while Individual C is a manager but not a member. All three are beneficial owners of the reporting company.

Individual A is a manager of the LLC and owns 50 percent of the company's membership units. Individual A exercises substantial control over the LLC because Individual A makes important decisions for the LLC in the role of manager. Individual A also owns 50 percent (which is greater than the 25 percent or more threshold) of the company's ownership interests. Individual A is therefore a beneficial owner of the reporting company in two different ways, by exercising substantial control and owning or controlling 25 percent or more of the ownership interests.

Individual B owns 50 percent (which is greater than the 25 percent or more threshold) of the LLC's membership units. That makes Individual B a beneficial owner of the LLC even though Individual B is not a manager and does not make important decisions or otherwise exercise substantial control over the LLC.

Individual C is a manager of the LLC and makes important decisions on its behalf, thereby exercising substantial control over it. Individual C does not own any of the LLC's membership units (the ownership interests) but is nevertheless still a beneficial owner because the individual exercises substantial control.

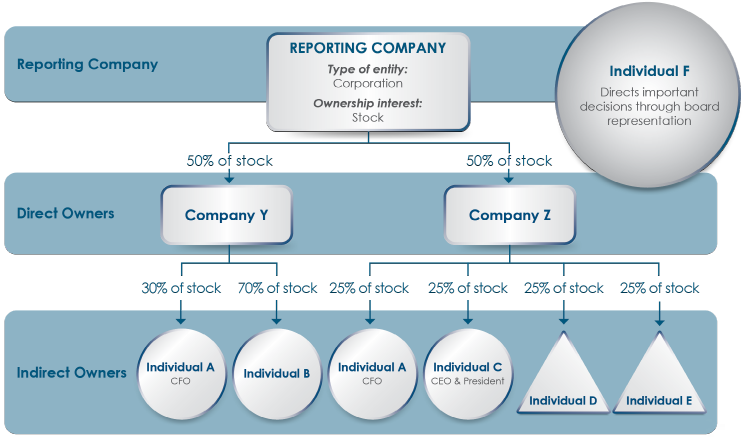

Example 4: A reporting company is a corporation with multiple indirect owners through Company Y and Company Z.

In this example, Individuals A, B, C, and F are beneficial owners.

Individual A is the reporting company's Chief Financial Officer and is therefore a senior officer, which under the Reporting Rule means that Individual A exercises substantial control over the company. Individual A also indirectly owns 27.5 percent of the reporting company's stock through direct ownership of Company Y and Company Z, which each own 50 percent of the reporting company's stock. (Individual A owns 30 percent of Company Y's stock and 25 percent of Company Z's stock. Therefore, Individual A owns 15 percent of the reporting company's stock through Company Y (50% � 30% = 15%) and 12.5 percent of the reporting company's stock through Company Z (50% � 25% = 12.5%). Adding these two percentages together equals 27.5 percent of the reporting company's stock.) Individual A is therefore a beneficial owner in two different ways, by exercising substantial control and owning or controlling 25 or more of the ownership interests of the reporting company.

Individual B indirectly owns 35 percent of the reporting company's stock through Company Y, which owns 50 percent of the reporting company's stock. (Individual B owns 70 percent of Company Y's stock (50% � 70% = 35%)). Individual B does not exercise substantial control. Individual B is a beneficial owner by owning or controlling 25 percent or more of the reporting company's ownership interests.

Individual C is the reporting company's Chief Executive Officer and president and is therefore a senior officer who exercises substantial control. Individual C indirectly owns 12.5 percent of the reporting company's stock. To calculate Individual C's indirect ownership interests in the reporting company, multiply the ownership interest of Individual C in Company Z by the ownership interest of Company Z in the reporting company. Individual C owns 25 percent of Company Z's stock and Company Z owns 50 percent of the reporting company's stock. Therefore, Individual's C ownership interests in the reporting company are 12.5 percent (25% � 50% = 12.5%), which is less than the 25 percent ownership interest threshold. Accordingly, Individual C's ownership interests in the reporting company do not make Individual C a beneficial owner, but Individual C is nevertheless a beneficial owner because Individual C exercises substantial control over the reporting company.

Similar to Individual C, Individuals D and E own 25 percent of Company Z's stock, and each therefore indirectly owns 12.5 percent of the reporting company's stock. In contrast to Individual C, Individuals D and E do not exercise substantial control over the reporting company. Individuals D and E are not beneficial owners.

Individual F is on the company's board of directors and makes important decisions on the reporting company's behalf, thereby exercising substantial control over it. Individual F does not own or control any stock in the reporting company. Individual F is therefore a beneficial owner by exercising substantial control over the reporting company, but not through holding ownership interests in it.